I’m

getting lots of emails and messages from readers in UK really worried

about the ongoing situation. My experience in Argentina is actually

pretty relevant, especially regarding inflation, devaluation and

banking. My blog is packed full of information, use the tabs and search

window. If you haven’t read them already, my books (

The Modern Survival Manual, Bugging Out) will provide very valuable information. I’ll try covering more Brexit advice in future posts and videos in my youtube channel.

As for now, you need to understand the following:

1)More

Poverty, more unemployment. Preparedness is mostly about getting ready

for what is likely. Snowstorms happen every winter in certain areas, so

you prepare for those. But sometimes preparedness is also about what’s

possible, even if unlikely. If you would have told me just a year ago

that the

British Pound would perform worse than the Argentine Peso

I would have told you to stop smoking crack, explain how bad that stuff

is for your health. Today the Pound is the worst performing currency in

the entire planet. This isn’t some anecdotic piece of news. This is

staggering. Inflation will occur, people’s purchasing power will drop,

imports will become more expensive, there will be less money, worse

infrastructure, less investments, therefore less jobs. Basically a

significant share of UK middle class will become poor and those that are

already low middleclass/poor, well, you’re looking at a VERY tough

situation ahead of you.

2) Inflation. With the

worst depreciation in 31 years the

consequences are just unavoidable. Prices will go up. They will go up A

LOT. You don’t just lose 21% and just pretend nothing happened. I’ve

seen it first hand and know very well what you will be seeing in the

years to come. Chances are you wont hear much of a buzz in the news, and

only certain media will report it. But you’ll notice it soon enough.

Mark my words one day you’ll be leaving Sainsbury’s, Tesco or Asda,

you’ll look at your trolly (Cart for Americans) and ask your husband or

wife “dear, how many pounds did we just spend? 150?”. You’ll think “hey,

that doesn’t look like 150 quid worth of grocery…”. Understand this,

the media will try to hide it and marketing will try to do the same.

Unless you check the net content they’ll trick you with their “new and

improved” packaging. Fuel will be another issue, already going up in

price.

Everything is linked and UK simply isnt much of an

industrial country. If its not imported then it’s using imported parts

or materials in its production. After years of being part of the EU,

this was simple, cheap and straight forward for companies but not

anymore.

3)Even worse medical care. The NHS was very bad already

but believe me when I say it will get even worse. People already died of

illnesses that other developed countries detected and treated in due

time. It’s a disgrace to read time and again about people being sent

home with a golf ball lump under their skin and be told its nothing by

their GP. With NHS women hardly get an Pap Smear and even for women with

a family history of breast cancer they just get check after 50… every

three years. Shameful.

4)More Xenophobia and hate crime. One of

the ugly sides of the Leave campaign was to subtly (and sometimes not so

subtly) appeal to the

racism and xenophobia some people have in UK, with hate crimes going up 57 to 147%.

It’s amazing given that London is such a multicultural city but we’ve

witnessed truly pathetic scenes such as Brit teen telling a Latino

looking man to go back home (turns out the man was an American army

veteran, living in Britain for more years than the teen has been alive).

In many cases its just people harassing other just because of an accent

or skin color. There’s this elder German women that lived in UK for

over 20 years, all of a sudden being told by her neighbours to go back

to her country.

The survival lesson is: If you’re not white, if

you’re and expat living there or just happen to have an accent, you will

be less welcomed in UK today that you would have been just a few months

ago and it will get worse. Official stats are showing just this, and

its really no surprise because it is in fact a government policy

implemented years ago to make the country less appealing for immigrants.

If this happens to be your case, I’d say it’s a big factor to take into

consideration. Think if you’re willing to put up with it, if you’re

willing to have your family, maybe your children suffer it as well.

5)Media

censorship. Its already quite noticeable, the BBC of course but most

British mainstream media are heavily controlled and report little actual

news. You need to understand this, understand that there’s a political

guideline which they follow, the way they report news and even which

news even gets reported. The Guardian and Independent seem to be more

likely to report the negative news which other official or non official

but government aligned agencies are likely to avoid.

When it comes

to news, you just need to understand who is reporting it, who owns the

given media corporation and what their interests are.

What to do:

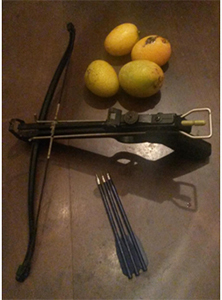

1.buy yourself a gun. NOW

Firearms

are already heavily restricted in UK and this will only get worse after

Brexit. The UK has been asking for tougher gun laws and nearly all

other EU countries have more permissible ones, allowing handguns and

semi auto rifles in most cases.

The reasons for owning a firearm

are numerous, and indeed you just don’t know what may happen one day.

What I do know, without a shadow of a doubt, is that if the day ever

comes and you do need a gun, you won’t have time to wait for several

weeks. You will need it right then and there. With the chances of

tighter regulations plus the likeliness of post Brexit social unrest, I

can only recommend getting yourself a shotgun, a quality semi automatic

one would be my preferred choice. Get your Firearm Certificate or

shotgun licence, join a club and practice. Ideally you would join a club

and get involved in shotgun practical shooting, which is the closest

you can get to defensive shooting skills in UK. Listen, as of today its

simple and straightforward enough. Tomorrow it may not be. This would be

my number one priority if living in UK right now.

2.Open a bank account offshore while you still can.

Now

this is something I was told about in Deutsche Bank here in Spain, just

today. UK is now considered a “high risk” country for money laundering,

along with several third world countries. You can imagine how

ridiculous this seemed and I said so to the clerk. The bank lady agreed,

but she said that since they are leaving the EU they understand there’s

a much higher chance that, as of right now, some people from UK would

try to open accounts abroad for money laundering. In any case, as of

today you should be able to find a bank in an EU country other than UK

to open an account. Do it while you can. This is a key asset to have.

3.Buy Euros. NOW.

The

Pound keeps dropping like a rock and this WILL NOT IMPROVE. You are

losing money, and right now you can do something about it, you still

have the option to go to any bank and get as many Euros as you can. From

now on until article 50 is triggered it’s a no brainer. Some will hold

until the last minute refusing to accept article 50 will be effectively

triggered. It will, and when it does you’ll see the pound drop even

further. If you have most of your money in Euros, it will be a lot less

painful. If you opened your account abroad as recommended, you can

easily send some of your savings there in Euros, move your money back

and forth as needed.

4.Stock up food and medical supplies

I

cannot emphasize this enough and it involves preparedness on several

levels. First and obvious enough, food will get more expensive. They

will try to hide it as much as they can but it’s unavoidable. If there’s

shortages, problems with supply (Britain is an island after all) having

a supply of food stocked is essential. If you lose your job, a stash of

food will give you some peace of mind. You’re going to eat anyway.

Remember to store what you eat. Try sticking to shelf stable food and

canned produce. Rice, beans, dry pasta, properly stored they will last

for years. Canned sausages are pretty common. Canned beans are a waste

of money in my opinion but some people like it. Try them out now, see

what you like and stock up.

5.Thousands in UK are already applying for Irish citizenship

This

would allow them to stay in the EU, travel, work and study in EU in

spite of the UK leaving. Having seen this first hand, if this is an

option you want to do this ASAP. Soon enough waiting periods will

increase considerably and as always you just never know if new

restrictions are implemented eventually. Being an island with a bunch of

countries right in front of you means you have options, but only if you

have the right to work, study and reside there. I believe many folks

just took that for granted and don’t fully understand how much their

options will be reduced once that right is lost. Again, If I was in UK

and had the option to apply for Irish or other EU country citizenship, I

would do it immediately.

6.Keep a cash stash, including Euros and precious metals.

These

are complicated times. You are looking at a period of instability and

uncertainty in which problems with the banking system and cash

availability are a possibility. As the pound keeps devaluating so does

your savings. In my case I have some GBP in my cash stash, just in case.

I felt the sting of seeing it lose value to the Euro. I can only

imagine how much worse it would have hurt if all of my savings where in

such currency.

My standard recommendation is to have at least a

month worth of expenses in cash, just in case. In the case of UK, I

would go for at least two months, and you probably want at least half of

that saved in Euros. There’s little doubt that the pound will keep

dropping.

Silver is another asset to consider. UK has Britannia

silver and gold bullion. I’d look into setting aside some as insurance

for a worst case scenario. Junk silver is also an option with pre 1920

British coins being sterling silver (92.5% silver) and pre 1947 coins

being 50% silver.

Check with your insurance company to see how

much it covers worth of cash, bullion and antiques & collectibles

(junk silver) In many cases the amount of cash covered is pretty low but

it can be increased if you have other forms of wealth which is yet

another reason for having them.

7.Try staying healthy and get private medical cover.

The

NHS being what it is its important to avoid it as much as you can. Stay

slim, fit and healthy. If you do this you’re already avoiding a fair

share of medical complications. If you don’t have private medical, I

would recommend getting at least their basic plan. UK is moving towards

private medical care and if you happen to need it I at least believe its

money well spent. The NHS will not cure, they will just distract you

until you die.

Staying healthy also means your medical premiums will be much lower, saving you money.

These

are complicated times. Some of the problems ahead are obvious and

unavoidable, the impact of others may be reduced with good policies but

still common sense preparation is highly recommended.

FerFAL

Fernando “FerFAL” Aguirre is the author of “The Modern Survival Manual: Surviving the Economic Collapse” and “Bugging Out and Relocating: When Staying is not an Option”.