Dear Ferfal,

I think I’ve read every blog post you’ve ever written. Long time fan. Thank you so much for sharing your experience and wisdom with everyone.

The Dow Jones just hit 20,000! I have a question about what the stock market is like when TSHTF. Like most Americans, I “own” stocks through my retirement plan. If inflation goes really high, is a stock like a gold ring that doesn’t have value until you sell it (and therefore increases with inflation), or will stocks kind of stay the same price, and therefore lose tremendous value? What happened in Argentina?

And I want to say that you have actually changed my life. I live in a very safe place, the kind of place where people still can leave their front door unlocked. Which I sometimes do when I go next door (on the other side of the porch), but I’ve made it a habit to always lock the door behind me when I come inside. If I come home and someone is inside, I can run away. But nobody’s coming in when I’m home unless I let them in (not too many ways out except the front door). Anyway, I think it’s a good habit, and I think I’m better prepared for what’s coming thanks to you.

Best Wishes,

-Adam

...

Hello Adam,

Thanks for being a long time reader. I’m glad to know I helped make your life a bit safer! These are all little things we do, habits and strategies that start building up as our mindset changes.

I see survivalism, at least the practical version of it that I call modern survivalism, as a lifestyle in which practical decisions are made keeping in mind the best possible outcome in a worst case scenario. Sounds paranoid but it’s not. If doing one thing instead of another improves my odds and quality of life (better, safer, more peace of mind) then it is the one that provides the most strategic advantages from a tactical point of view. From the items in your EDC, the clothes you wear, the car you drive and the place where you live.

Regarding the stock market in Argentina during the crisis, here yet again we see that common assumptions and what actually ends up happening during an economic collapse have little in common.

Of course, the stock market has collapsed in the past and such a possibility is something to keep in mind, but we must remember than these situations are pretty complex, both in causes and effect. It is crucial to fully understand the former to correctly predict the latter.

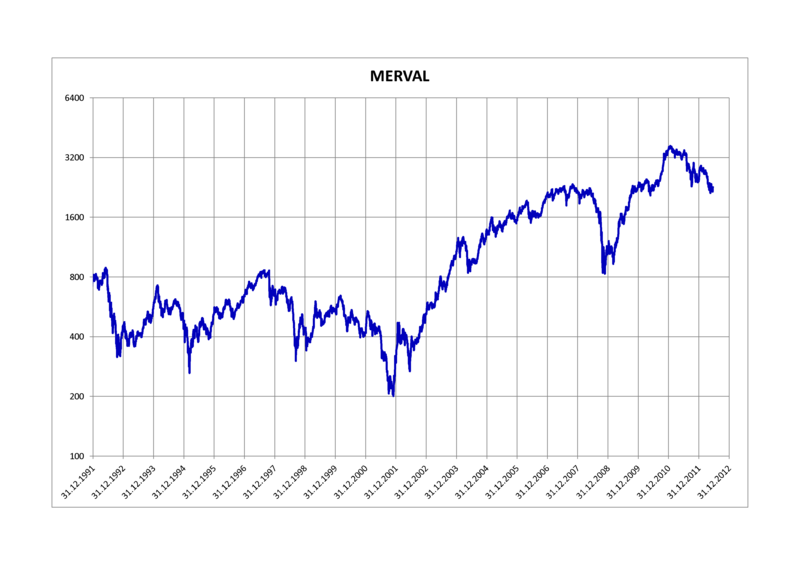

Here is where we must ask ourselves, what caused the collapse in the first place? In the case of Argentina it was a bank run followed by a devaluation. The knowledge of an impending devaluation and rumours of accounts being frozen obviously triggered such bank run. If the same had happened for example with stocks, rumours of a bubble, followed by sharp sales and loss of value the story would have been different. The chart below reflects the Merval, the most important index of the Buenos Aires Stock Exchange.

We clearly see a big drop as expected at the time of the economic collapse in December 2001, but then as time goes by it starts going up, even as the Peso goes down, why? Well, the price is now in Pesos no longer pegged to the dollar, but even more important is that stocks represented something physical to own, a part of a company (even a struggling one!). Even if people suffered it often occurred that companies did well eventually. The common saying in Argentina years after the crisis about “its great that the economy is doing much better. Too bad we don’t get to see any of it” reflects just that. With a 25% inflation per year anything that held its value was better than the Peso. Real estate, US Dollars and yes also stocks.

I would say that looking at it from a historical perspective, good time-proven stocks tend to do well on the long run. High risk ones are more of a question mark. It sure isn’t a chunk of gold or silver in your hand, but the chances of it being worth only the paper they are printed on and the company going belly up isnt as high if you invest wisely. As always, don’t keep all your eggs in one basket and so on.

FerFAL

Fernando “FerFAL” Aguirre is the author of “The Modern Survival Manual: Surviving the Economic Collapse” and “Bugging Out and Relocating: When Staying is not an Option”.

No comments:

Post a Comment